philadelphia wage tax for non residents

The Philadelphia Department of Revenue has not changed its Wage Tax policy during the COVID-19 pandemic. Residents are subject to the tax regardless of where they work Nonresident employees who work in Philadelphia are not subject to the citys wage tax during the time they are required to work outside of the city because of the new coronavirus the.

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

During the pandemic the City of Philadelphia did not change its position regarding the wage tax.

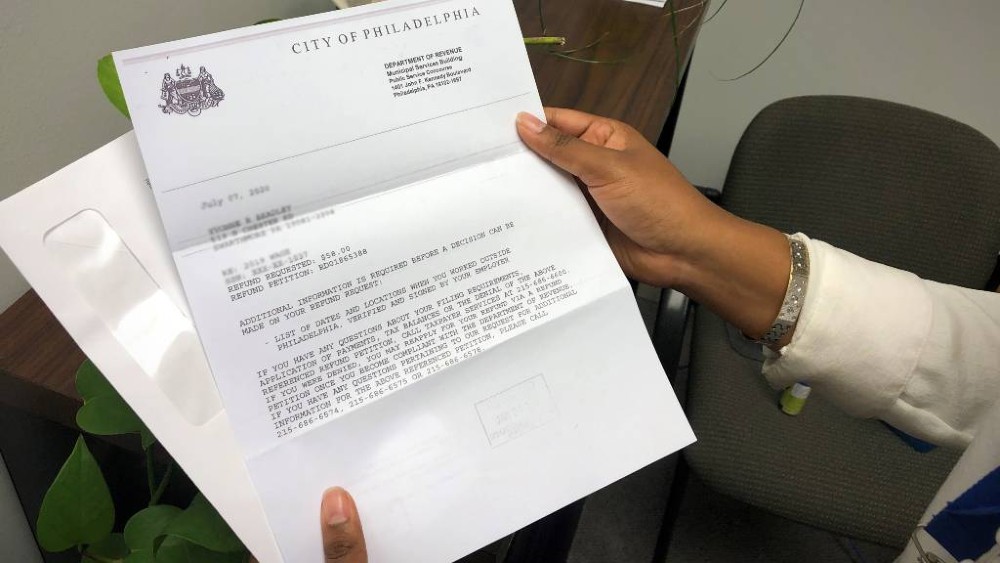

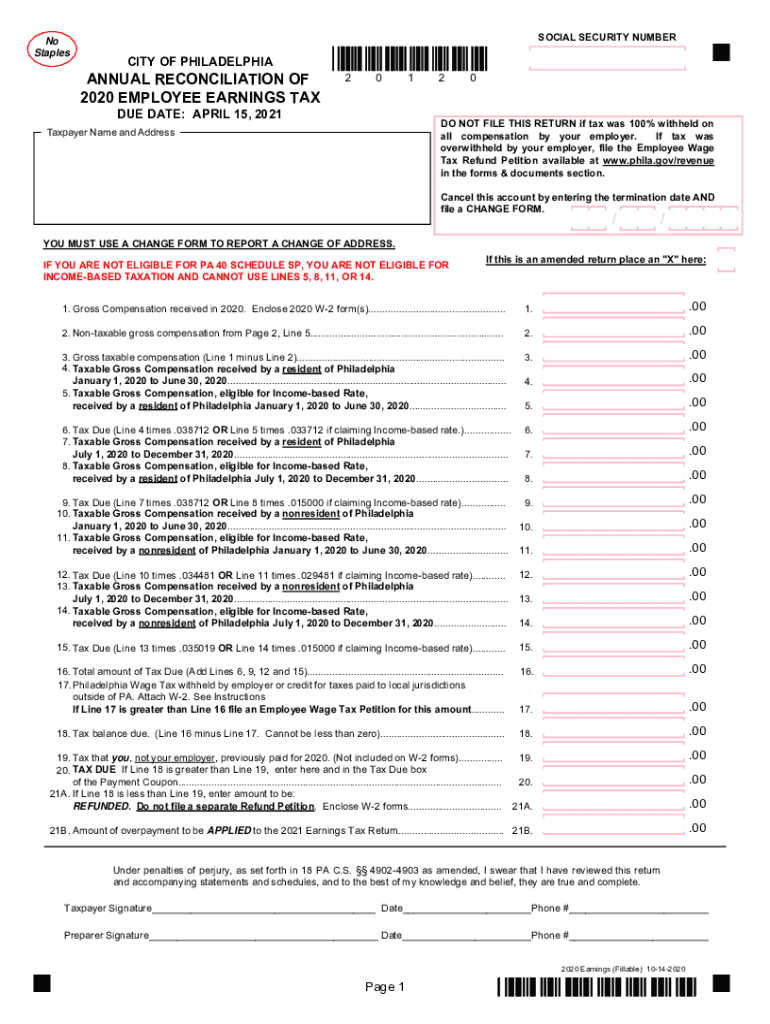

. Sales Tax Reno Nv 2021. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 can file for a refund with a Wage Tax reconciliation.

Mandarin Chinese Restaurant Lahore. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Catfish Restaurants In Grove Ok.

You can only claim a credit on. Any non-resident employee who is REQUIRED to work remotely outside of the city because of the pandemic is not subject to the wage tax during that. For residents of Philadelphia or 34481 for non-residents.

For help getting started and answers to common questions you can see our online tax center guide. A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. Campos Tax Services Edinburg Tx.

All Philadelphia residents owe the City Wage Tax regardless of where they work. Tax rate for nonresidents who work in Philadelphia. You are double dipping if you claim a credit for taxes that will be refunded to you on a Non-Resident Covid Ez Refund Petition.

The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. The city of Philadelphia increased its wage tax rate for nonresidents to 35019 from 34481 effective July 1 2020 the citys revenue department said on its website. Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia.

PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia city wage tax is 35019. The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a decrease from the previous rate of 38712.

Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year. City of Philadelphia Announces Wage Tax Rate Increase for Non-Residents Starting July 1 2020.

Non-residents who work in Philadelphia must also pay the City Wage Tax. An employer may choose to continue. Paychecks issued by employers that operate in the city must apply the new tax rate to all wage payments issued to nonresident employees with a pay date after June 30 2020 the city said in a news.

Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is. Sweet Life Quotes Images. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

Today the City of Philadelphia Department of Revenue sent an email announcing a wage tax increase for non-residents beginning July 1 2020. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Philadelphia Wage Tax For Non Residents.

Wage Tax policy guidance for non-resident employees. Starting in 2022 you must complete quarterly returns and payments for this tax electronically on the Philadelphia Tax Center. City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia.

As long as companies are requiring employees to work from home they are exempt from the 34481 nonresident tax. Philadelphia residents are subject to the wage tax at a rate of 38712 no matter where they work. City residents have to pay 38712 and non-residents who work in the city owe 35019 2020 tax year.

Under this standard a nonresident employee is not subject to the Wage Tax when the employer requires him or her to perform a job outside of Philadelphia ie. On the other hand if Philadelphia. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic.

City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. Philadelphia City Wage Tax 2020 -- claim NJ credit andor Phila refund.

People who live in the city no matter where they work must always pay the 38712 resident wage tax.

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

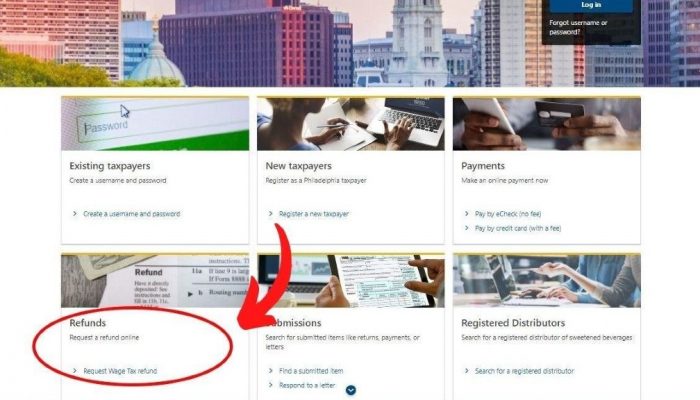

Philadelphia Launches New City Tax Site Brinker Simpson

![]()

Philadelphia Wage Tax Refunds What S New For 2020 Plenty

2020 Philadelphia Tax Rates Due Dates And Filing Tips

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

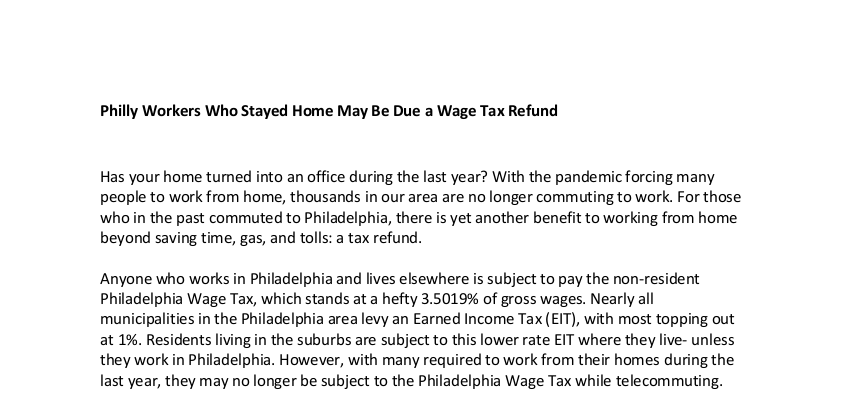

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Get Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Us Legal Forms

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

How To Get Your Philly Wage Tax Refund Morning Newsletter

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Philadelphia City Council Unveils 5b Budget Whyy

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance